ANNUITIES

We are confident our annuity products will provide a welcome solution for advisers and their clients, from a company that has been at the forefront of innovation in the UK annuity market. Our annuity products are a flexible solution in a market where differentiation is difficult to find.

Following STM Group’s acquisition of London & Colonial Holdings Limited in 2016, the Gibraltar based life assurance provider London & Colonial Assurance PCC Plc (LCA) now offers two investment linked annuity products, the Flexible Pension Annuity (FPA) and the Flexible Life Annuity (FLA) for the UK tax resident market.

Both annuities utilise LCA’s Protected Cell Companies (PCC) structure which affords a high level of policyholder protection. In addition to this, both are covered by the UK Financial Services Compensation Scheme.

THE FLEXIBLE PENSION ANNUITY

The Flexible Pension Annuity (FPA) is a pension annuity purchased on behalf of the policyholder by the trustees of the pension scheme holding the pension assets. The product allows full flexibility, providing the policyholder the option to elect how much income to take each year in line with pension freedoms. The policy is purchased by the trustees of the registered pension scheme, therefore there is greater investment flexibility.

THE FLEXIBLE LIFE ANNUITY

The Flexible Life Annuity (FLA) is a life annuity that can be purchased out of any available funds. During the lifetime of the annuity, the policyholder can elect to change the amount of the annuity payments (either increase or decrease). A wide range of assets is allowed in the FLA. HM Revenue and Customs personalised bond rules apply, so investments need to be advised by a qualified investment adviser.

The FLA and FPA are taken out on the basis of an annual or monthly annuity based on age (and hence life expectancy) and investment return.

The calculated annuity amount (based on age, and hence life expectancy, and investment return) is expected to exhaust the fund at the normal life expectancy of the annuitant. The annuities provide the flexibility for the level of annuity payments to be changed at any time during the lifetime of the annuitant.

LCA does not provide financial or investment advice. Our products are distributed through financial advisers, so our service features are designed to give maximum support to all of our intermediary partners.

London & Colonial Assurance PCC Plc (‘LCA’) is a Gibraltar based life insurance company operating out of Gibraltar’s highly regulated and long established financial centre. LCA was established in 2001 as a public limited company and a life insurance provider and is part of STM Group since 2016.

LCA is licensed to write Class I – Life and annuity and Class III – Linked long-term assurance business and was primarily established to provide an alternative to conventional annuities for high-net-worth individuals wishing to use their pension funds to purchase an annuity that provides greater flexibility for income and investment choice.

WHY GIBRALTAR?

Gibraltar was chosen as it observes high standards of supervision and financial regulation and was the first EU jurisdiction to offer Protected Cell Company (PCC) legislation. This type of structure is available in many overseas jurisdictions but is not yet recognised under corporate law in the UK or EU member states.

LCA is subject to continuous regulation by the Gibraltar Financial Services Commission (GFSC), the regulatory authority for all financial services providers operating in and from Gibraltar.

In their country risk analysis published in August 2018, AM Best categorised Gibraltar’s economic, political and financial risk as a CRT-1 country with a very low level of risks in all categories. Specifically, a CRT-1 country is defined as having a “predictable and transparent legal environment, legal system and business infrastructure; sophisticated financial system regulation with deep capital markets” and a “mature industry framework”.

Both annuities currently marketed by LCA are covered by the Financial Services Compensation Scheme (FSCS). In the unlikely event that LCA were to default on claims under its policies, sales of its products conducted in the UK, to UK residents at the time the contract commenced, are covered by the ‘protected contracts of insurance’ part of the FSCS. Please see the FSCS website for full details: www.fscs.org.uk

PROTECTED CELL COMPANY (PCC) LEGISLATION

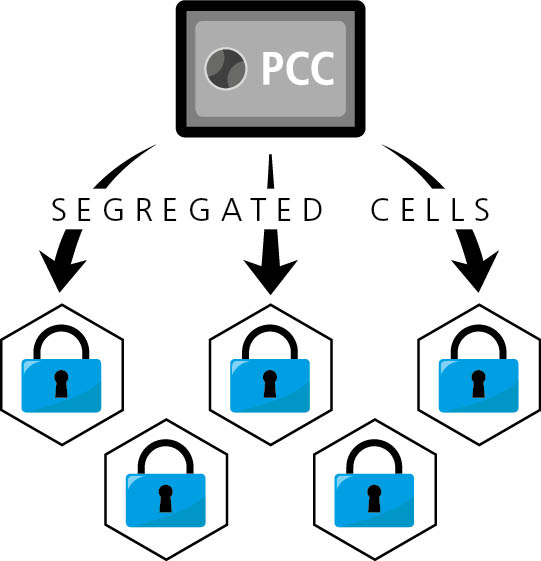

LCA's annuity products utilise the Protected Cell Companies (PCC) structure as it affords a high level of policyholder protection.

A PCC structure is subject to the provisions of specific Gibraltar PCC Law which was implemented in 2001 (Protected Cell Companies Act 2001). In a PCC, legally recognised ‘cells’ are created within the company in order to segregate and protect each policyholder’s assets from other policyholders and the company itself. This means that each individual policy is linked to a ‘cell’ and the assets backing the policy are owned by the ‘cell’ and hence completely legally ring-fenced from all other policyholders’ and shareholders’ assets. Put very simply, a PCC is a form of company comprised of individual parts, known as ‘cells’.

WHAT THIS MEANS FOR THE LCA ANNUITY

For each client that purchases an LCA annuity, a unique ‘cell’ is opened within LCA.

Each ‘cell’ has its own designation (the policy number) and is completely independent of all other ‘cells’ and of the company’s core. It is the Directors’ duty to keep and account for the assets and liabilities of each ‘cell’ separately. The PCC legislation prohibits the assets of a ‘cell’ to be used to satisfy any liability not attributable to that ‘cell’.

It is similar to a honeycomb where the cells are all individually protected within the beehive.

In the unlikely event that anything should happen to LCA, your client’s policy (and the assets within the policy) would remain secure from and untouched by any potential creditor. In other words, each ‘cell’ is ring-fenced from all other ‘cells’, providing 100% policyholder protection.

Please note: 100% policyholder protection does not apply to the ongoing valuation of the investment as the value of investments can fall as well as rise. All the assets that LCA purchases within each policy are legally and beneficially owned by LCA. The policyholder has purchased the rights to the value of these assets but the policyholder does not own the assets. LCA does not make investment decisions. LCA will only purchase or sell assets within any policy if LCA receives a written request from the appointed investment adviser associated to the specific policy.